Cellular networks keep advancing. Cell phones, which once relied on 1G, are now running on 4G, and 5G is becoming more common.

But about 10%-20% of fleets still operate 3G devices, particularly for telematics, according to Ryan Powell, senior vice president at Velociti, a technology solutions provider.

That could pose a problem, as providers begin to phase out 3G, which takes up space on the spectrum. AT&T plans to sunset its 3G service next February. On Dec. 31, 2022, Verizon is planning to shut down its 3G network.

Once the sun sets on 3G, communication devices running on the legacy network will not work. So, fleets that aren't already running on 4G need to make changes in the near future.

Putting off the transition

Fleets vary on their current use of 3G tech. Some still have mostly 3G, some run with half 3G and half 4G, while others have little exposure to 3G.

"It's not uncommon for trucking companies to still have 3G exposures," said Scott Sutarik, vice president of commercial vehicle solutions at telematics provider Geotab. "That's because converting has the potential to take a lot of time, may be costly and can be a complex project."

In the short term, Powell said, trucking companies can still utilize their 3G devices and hardware with the same reliability that they're accustomed to. That's one reason fleets might not yet have migrated to 4G.

By delaying the switch, firms can temporarily avoid the capital expense of new hardware. Also, fleets may be fulfilling existing contracts with their providers.

Sutarik also cited the global shortage of semiconductors as a cause of not moving on to 4G. The semiconductors that telematics devices use share chips with the automotive industry. There is a lot of demand for those chips now, he said, and some vendors have struggled with supply.

"Converting [to 4G] has the potential to take a lot of time, may be costly and can be a complex project."

Scott Sutarik

Vice President of Commercial Vehicle Solutions at Geotab

But by not converting soon, fleets put their businesses in jeopardy.

Although the obstacles involved with transitioning to 4G — cost, difficulty, time lost — are legitimate, fleets that don't start the changeover soon may very well experience a decrease in performance, said Powell.

"Everything is okay, until it's not," said Sutarik. "Not transitioning out of 3G can mean lost connectivity, data from the ELDs mandated for hours of service can't be offloaded, and when the network starts going down, the impacts can be felt across all operations."

Fleets may not know where their trucks are located, and they could lose the ability to manage their business, Sutarik said.

4G's edge

Although the costs associated with being technology-forward can be considerable, the benefits far outstrip any short-term inconveniences to the bottom line, Elizabeth Elkins, chief product officer at PowerFleet, a provider of subscription-based wireless connectivity solutions, said in an email.

"Data connectivity and transfer speed give a substantial edge to 4G/LTE over its predecessor, transferring up to 100 megabytes per second — several hundred times faster than a 3G-enabled device," said Elkins.

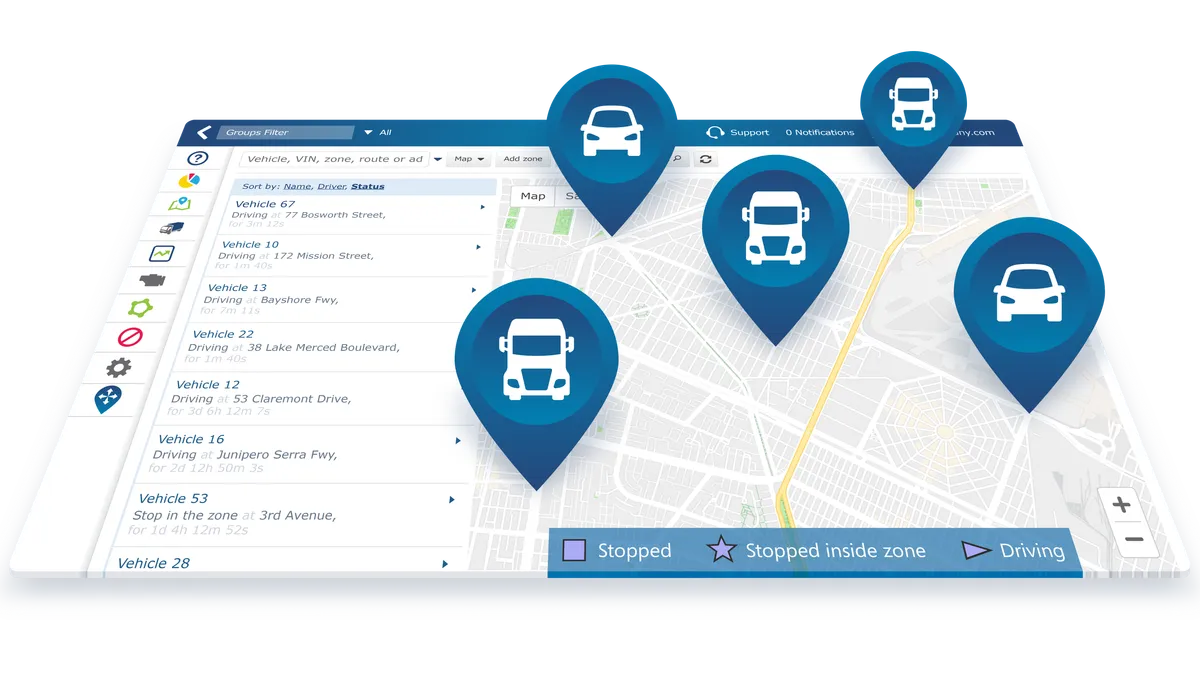

That means the fleet-related insights provided by telematics are now closer to real time. So, asset tracking is more consistent with the actual location of the asset, she said. 4G also enables a more accurate estimated time of arrival, which helps meet customer expectations.

The five Gs

| Generation | Main features |

|---|---|

| 1G | Eliminated the need for phone cords |

| 2G | Digital replaces analog; enables encryption and multimedia messaging |

| 3G | Mobile internet access and video calling |

| 4G | Data speeds with support for gaming and video conferencing |

| 5G | Faster data rates and energy savings |

Source: Federal Communications Commission

"Data connectivity is more reliable with 4G LTE networks, especially in heavily congested wireless networks like loading docks and parking lots," said Elkins.

The 4G and 5G spectrums, along with private networks, allow for unprecedented data speeds, said Powell. This opens doors to emerging technology ranging from smart trailers to more efficient dock operations, higher utilization, autonomous assets and beyond.

"It's an exciting time in the industry and by adopting early, fleets can leverage technology to continually improve their operations," Powell said

Fleets assess the marketplace

Fundamental to the transition process is identifying providers in the market that maximize ROI by offering technology at an affordable price point, Elkins said.

Fleets must first engage with their current provider and discuss the challenge of upgrading their asset tracking solutions, but also look at other possibilities.

"Everything is okay, until it's not."

Scott Sutarik

Vice President of Commercial Vehicle Solutions at Geotab

This exercise involves evaluating products in the marketplace and understanding which of them will fit well within their operations. Vendors are providing solutions to help with this.

Velociti recently launched an innovation lab, which Powell said is like a playground. There, technology partners and fleets can test hardware and software functionality prior to deployment.