Dive Brief:

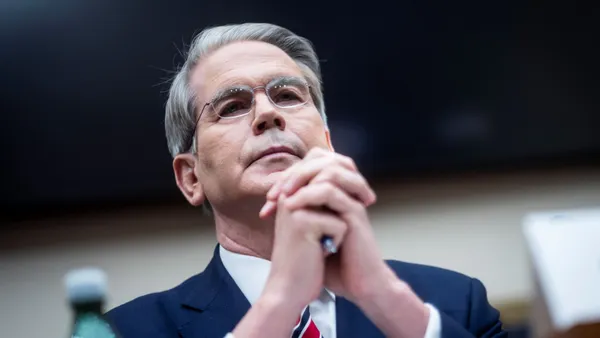

- YRC Worldwide has begun replacing its fleet after obtaining a $700 million loan from the federal government under the Coronavirus Aid, Relief, and Economic Security Act, said YRC CEO Darren Hawkins during Monday’s earnings call. Hawkins said the LTL firm has spent almost $75 million of the loan on 300 new tractors, 950 new trailers and some used equipment. YRC will take delivery late in the year.

- The tractors are part of YRC’s cost-cutting plan, as its aging tractor fleet and other equipment were costing too much, in terms of maintenance and fuel. The tractors will also come with enhanced safety technology.

- YRC also said it will change its holding company name, from YRC Worldwide to Yellow, the original name of the company. Regional brands Holland, New Penn, HNRY Logistics, Reddaway and YRC Freight will continue to operate under their names. Yellow will consolidate its network to make the brands work more efficiently with each other, said Hawkins.

Dive Insight:

Hawkins said he was upbeat about the outlook for YRC after its struggles earlier this year. He told analysts that he sees strong market conditions continuing into Q4, even though some fleets typically see the final quarter as their weakest. But Hawkins noted recent imports into Los Angeles and Long Beach ports in California are driving demand for trucking.

LTL tonnage per day decreased by 4.1% in Q3 YoY, the company reported. But it improved 6.2% in September as compared to August, helping to offset losses. YRC said its net loss for Q3 was $2 million, compared to a net loss of $16 million YoY.

“The consumer is standing up good;trucking capacity is very tight; housing, construction and demand is strong; imports are at record levels — and what we’re seeing on the West Coast, I haven’t seen in my entire career as far as the demand environment,” said Hawkins.

YRC officials also said that in early December, it will be implementing a planned intermodal change of operations in Memphis, Tennessee. The change will allow the movement of shipments loaded on intermodal containers on the rail to and from Western U.S. operations, said COO T.J. O’Connor.

“This is a key change that will provide increased capacity while improving efficiencies,” said O’Connor.

But as volumes increase, the driver shortage is causing capacity problems, which is a common complaint from fleets. YRC has a driver-training program in place and is bringing back drivers laid off during the early stages of the COVID-19 pandemic. YRC is also adding “pop-up,” or mobile, CDL schools, said O’Connor.

“We also see great potential in our box-truck drivers who are part of the YRC team but are not yet qualified with a CDL,” said O’Connor.

The driver shortage has consistently grabbed the No. 1 ranking of industry concerns, as reported by the American Transportation Research Institute. It was the fourth-consecutive year the shortage topped the list.

The institute reported that the FMCSA Drug and Alcohol Clearinghouse has increased the shortage problem as substance violations have forced offending drivers out of the industry. COVID-19 also persuaded many older drivers to retire or switch industries, ATRI reported. Retirements are also a particular weakness for the industry, as it seeks to add fleet drivers.