Dive Brief:

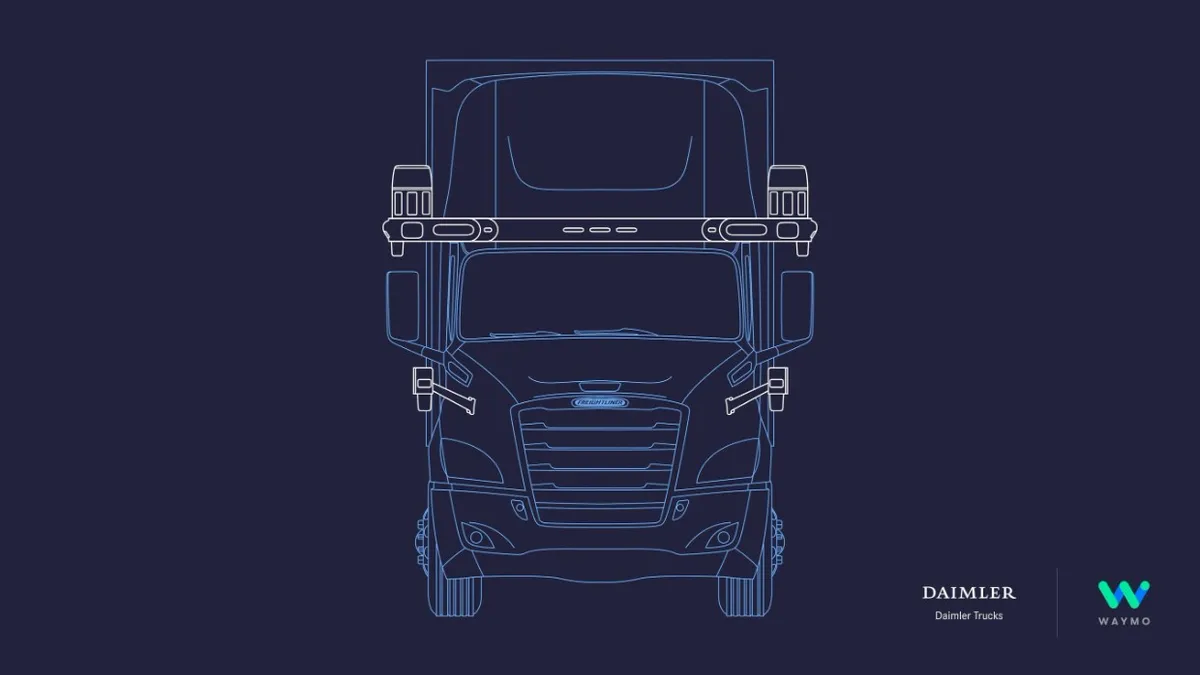

- Daimler Trucks and Waymo have signed a deal to put level 4 autonomous technology on a Freightliner Cascadia, the companies jointly announced Tuesday. Work has begun on combining Waymo Driver with the Class 8 truck for the U.S., a Waymo spokesperson said in an email.

- The companies will work together to redevelop and redesign the Freightliner Cascadia to host Waymo Driver. "Right now, you can't order or easily build a truck with all of the redundant safety features necessary for fully autonomous driving, such as redundant braking and steering," the spokesperson said.

- Along with the initial effort, Daimler and Waymo will also "investigate expansion to other markets and brands in the near future," the companies said in a news release.

Dive Insight:

OEMs without autonomy projects in the works risk falling behind the pack, and fleets are keen to keep tabs on the technology's progress so they can be ready to reap the benefits driverless operations promise.

Daimler is helping to set the pace for OEMs, acquiring a majority share in automated driving technology company Torc Robotics in 2019. Navistar then took a minority stake in TuSimple in July to develop level 4 autonomous trucks, and production could begin in 2024.

The companies are testing their vehicles in the Southwest. TuSimple is operating in Arizona and Texas, while Torc's level 4 system will be tested on a Freightliner Cascadia in that region early next year.

"The strategic partnership with Waymo actually complements Daimler Trucks' dual strategy approach of working with two strong partners, Waymo and Torc, to deliver highly automated L4 solutions to customers," a Daimler spokesperson said in an email. The two projects are independent, though.

Partnering with Daimler is a step toward fulfilling Waymo's long-term strategy, which it calls its driver-as-a-service model. The business plan involves the company partnering with truck OEMs and tier 1 suppliers to deploy autonomous trucks within fleets.

Waymo does not intend to be involved in fleet management, maintenance or operations. "While we continue to test our Driver in Class 8 trucks over the coming years, we'll operate our own fleet of trucks and will offer freight services to fleet customers, deeply integrated in their fleet operations," the spokesperson said.

Waymo will focus on highway driving in the near term — a scenario well suited for autonomy due to its predictability — as well as limited operations on surface streets to LTL terminals, warehouses or distribution centers.

"Adoption will grow as the technology is thoroughly validated and tested in specific use cases, starting with linehaul, on-highway applications on simple interstate scenarios and in fair weather conditions," Stephan Olsen, general manager of the Paccar Innovation Center, previously told Transport Dive in an email.

Fleets are already adopting automation in other capacities. Roadrunner Transportation Systems installed dock automation for shipment tracking, and 80% of orders in Schneider's for-hire TL business are processed using automation. But not many fleets are investing in automated tractors just yet.

Wilson Logistics signed a deal for what Locomation said was the "world's first autonomous truck purchase order," when it agreed to put Locomation's Autonomous Relay Convoy technology on at least 1,120 of its tractors. The two companies already had a commercial agreement through 2028 and had already begun working on testing programs together.

The convoy system is for platooning, which can save fuel and reduce carbon emissions. Autonomous trucks in general promise to improve fuel economy, increase safety and ease the driver shortage.

Mike Roeth, executive director for the North American Council for Freight Efficiency, recommended fleets work with OEMs on autonomy early rather than down the road, even though deployment could be years from now.