Dive Brief:

- A federal bankruptcy judge ruled this month that Yellow Corp. must pay at least some of the $6.5 billion in withdrawal liability claims filed by 11 multiemployer pension plans in the carrier’s bankruptcy.

- Judge Craig Goldblatt rejected Yellow’s argument that $40 billion in payments under the American Rescue Plan Act should reduce or eliminate the carrier’s liability, according to a 42-page ruling on Sept. 13.

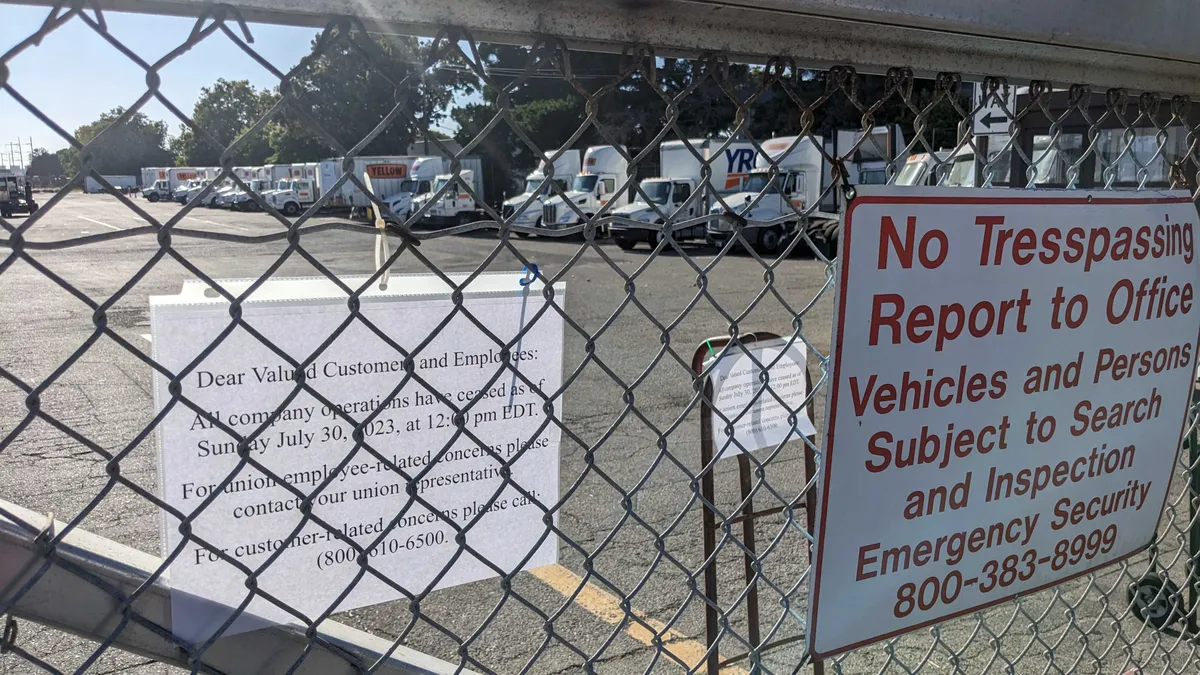

- The judge ruled the company, which employed 22,000 union workers, cannot avoid payments it owed to Teamsters pension plans when it shuttered and withdrew early from the plans.

Dive Insight:

More than a year after the largest bankruptcy in trucking history, the shuttered LTL carrier has sold almost $2 billion in real estate and repaid its $700 million federal COVID-19 relief loan.

But the pension plans claims, which the judge ordered the parties to further negotiate, are among several open ends in the company’s bankruptcy case.

Others include a class-action lawsuit brought by employees who claim the company failed to provide adequate notice of mass layoffs — and the question of whether International Brotherhood of Teamsters General President Sean O’Brien must sit for a deposition by the carrier’s lawyers.

Goldblatt, who ruled earlier this month the union head’s deposition should proceed, denied a motion by the Teamsters to halt it during a virtual court hearing Tuesday. The judge allowed a seven-day administrative stay to allow the union to seek an appeal.

“Given the number of claims at stake and the attendant implications to the estate, delaying that proceeding does have the risk of delaying the entire bankruptcy case,” Goldblatt said. “That harm outweighs the inconvenience associated with subjecting Mr. O'Brien to a three-hour deposition.”