Editor's note: Following the first batch of winning real estate bids, we mapped which bidders are poised to acquire more than 100 different terminals. Check it out here.

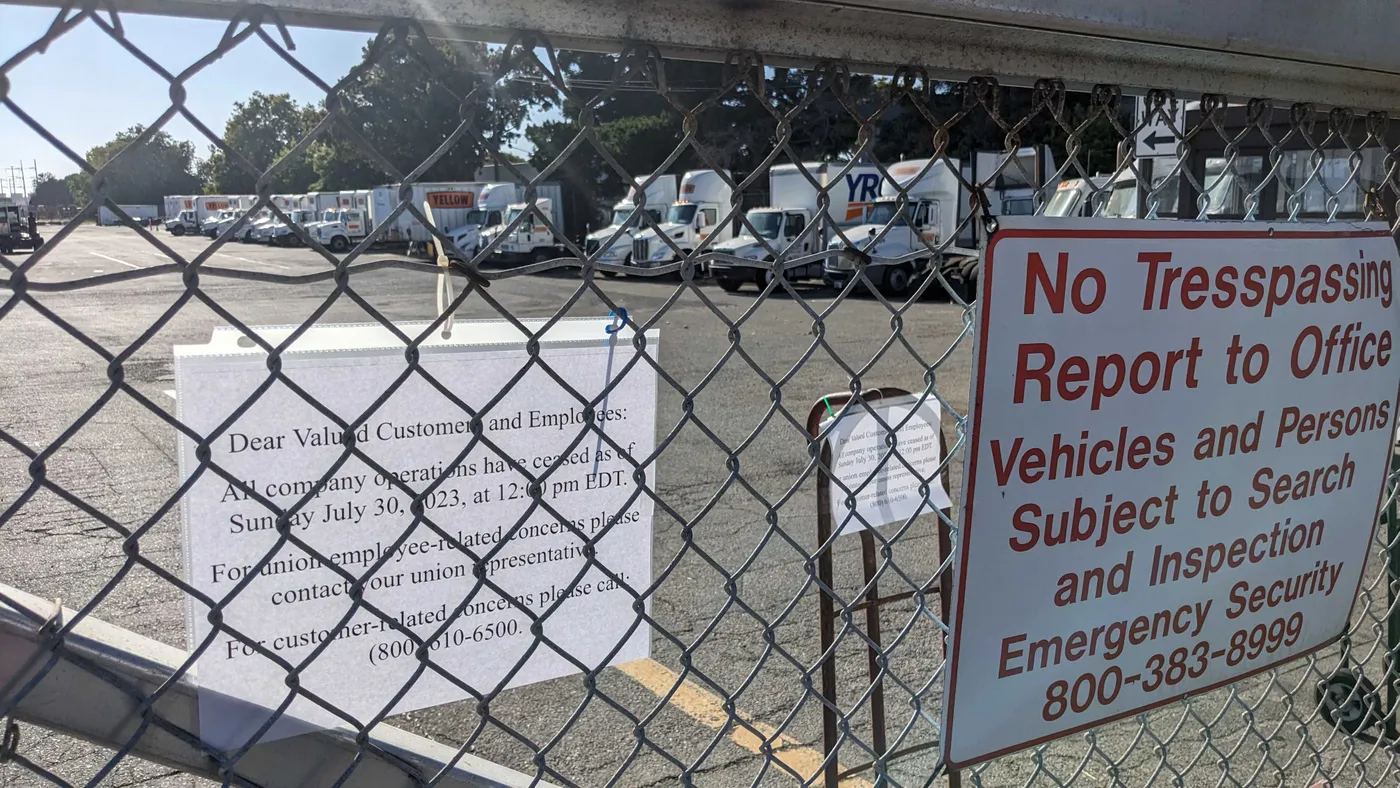

Yellow Corp.’s terminals in the U.S., Canada and Mexico will soon become available for rent or sale as part of the trucking firm’s bankruptcy and liquidation.

The century-old LTL giant has more than 300 facilities in its network, and it owns 169 terminals. Prospective bidders can submit their interest by 5 p.m. EDT Aug. 18 and a bid by Oct. 15, according to a proposed bankruptcy timeline. If required, an auction will be held to assign out assets, including leases and equipment, on Oct. 18.

Yellow has contacted 200 possible buyers as part of its pre-bankruptcy proceedings and has provided due diligence materials to 63 unnamed parties, court documents show.

The real estate sell-off has already spurred interest from some of the firm’s competitors, which in earnings calls said they are prepared to act if a strategic opportunity arises. Trucking executives will be assessing newly-available terminals’ size, location and network when considering an acquisition, analysts told Transport Dive.

Yellow’s massive network — built over a century through growth and acquisition — could have several valuable targets. The network includes hundreds of terminals in the United States, plus several in Canada, Mexico and a few U.S. territories, according to an online database of terminals Yellow provides for customers, which was compiled into a list by Transport Dive. The list includes terminals operated for all of the company’s brands, including YRC Freight, Reddaway, Holland and New Penn.

A Yellow spokesperson cautioned the database may be outdated and include terminals that were consolidated under the One Yellow plan, but did not provide a more recent list. The company had 308 transportation service facilities in 2022, according to its 10-K, a few dozen fewer than are shown on the map.

Where are Yellow's 300+ terminals?

Yellow owns several terminals in major markets that could bring a good return, said Satish Jindel, an LTL industry expert and observer.

“Anything they own is going to be on sale,” he said, highlighting Yellow’s terminals in New Jersey, Dallas, Atlanta and Denver as potentially valuable targets.

Terminals in the Northeast are particularly difficult to secure, so Yellow facilities in the region could be a draw for competitors like Knight-Swift Transportation Holdings’ LTL segment, said Craig Decker, who leads investment banking activities across transportation, supply chain and logistics areas for Brown Gibbons Lang & Co.

"There are some great terminals that can be picked up," he said. "So from a real estate perspective, this could be interesting if another carrier needs to expand into that area or wants to expand in that area."

The full list of Yellow terminals compiled by Transport Dive can be found below, along with their addresses and an automatically-generated Google Maps link to the terminals’ location.