Dive Brief:

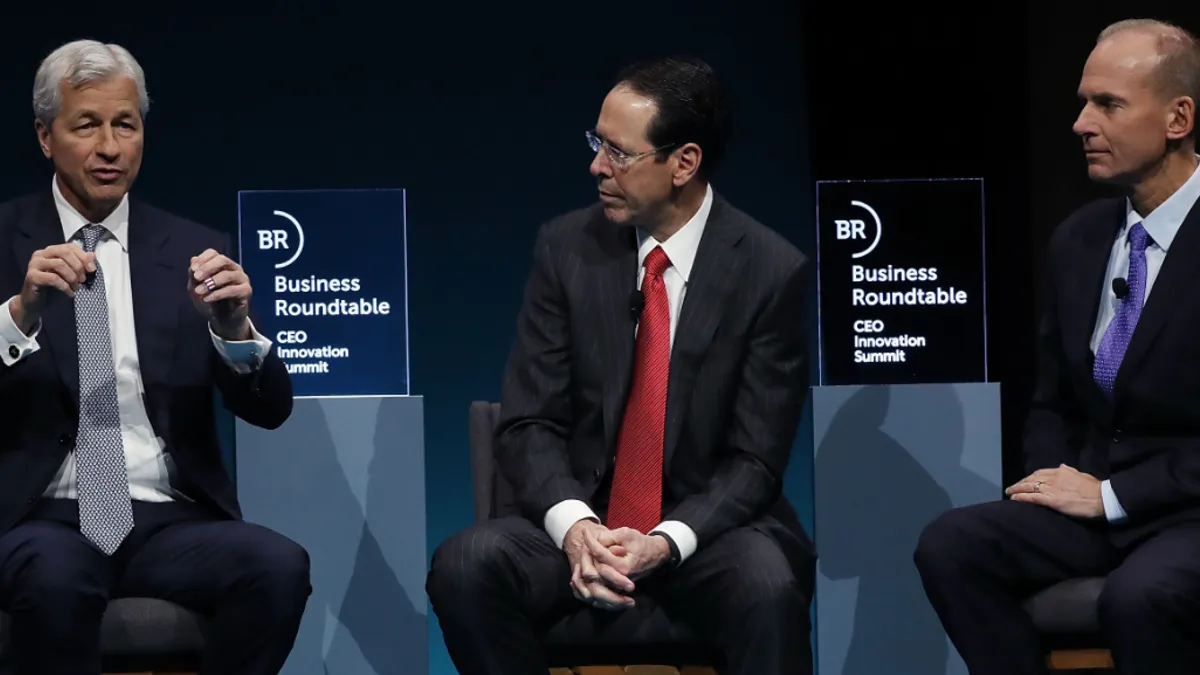

- CEOs at the biggest companies increased their estimates for growth in U.S. GDP this year to 5% from 3.7% and plan record hiring during the next six months, according to a Business Roundtable survey of 172 CEOs.

- The corporate leaders also upgraded plans for capital expenditures and sales, pushing up the Business Roundtable’s CEO Economic Outlook Index to the highest level since Q1 2018, according to results of the survey conducted from May 25 until June 9.

- "CEO optimism near historic highs, particularly with record hiring plans, is a strong sign that we are climbing out of this unprecedented crisis," Doug McMillon, Walmart CEO and Business Roundtable chairman, said in a statement, noting "an extremely successful vaccine rollout" in the U.S.

Dive Insight:

Three in four CEOs said conditions for their companies have recovered to pre-pandemic levels or will do so by the end of this year, the Business Roundtable said. One in four business leaders do not expect a full recovery until 2022 or later.

Although optimistic, the CEO estimate for 2021 economic growth is less sunny than some official predictions. The International Monetary Fund in April forecast 6.4% U.S. growth this year, while the Federal Reserve said last week it upgraded its estimate to 7% from 6.5% in March.

Robust corporate hiring should help reduce U.S. unemployment, now at 5.8%.

"Conditions in the labor market have continued to improve, although the pace of the improvement has been uneven," Fed Chairman Jerome Powell said last week after a meeting of central bank policy makers.

As freight booms, fleets are jostling for position as they fish in the relatively small pool of available drivers. But due to factors specific to trucking and common across industries, the years-long driver shortage persists.

Trucking employment has not recovered to pre-pandemic levels

Even with big gains in such sectors as leisure and hospitality, total employment is still 7.6 million jobs below pre-pandemic levels. Powell said parental caregiving, fears of COVID-19 and unemployment insurance payments may inhibit job growth — and company hiring.

A high rate of retirement since the start of the pandemic may also hold down labor participation, Powell said. Some 2.6 million workers retired between Feb. 2020 and April 2021, according to estimates by the Dallas Fed.

Unemployment will decline to 4.5% by the end of this year and to 3.5% by the end of 2023, according to estimates by Fed policy makers.

The Business Roundtable represents CEOs of companies with 20 million employees and more than $9 trillion in annual revenues.

S. L. Fuller contributed to this report.